child tax credit portal

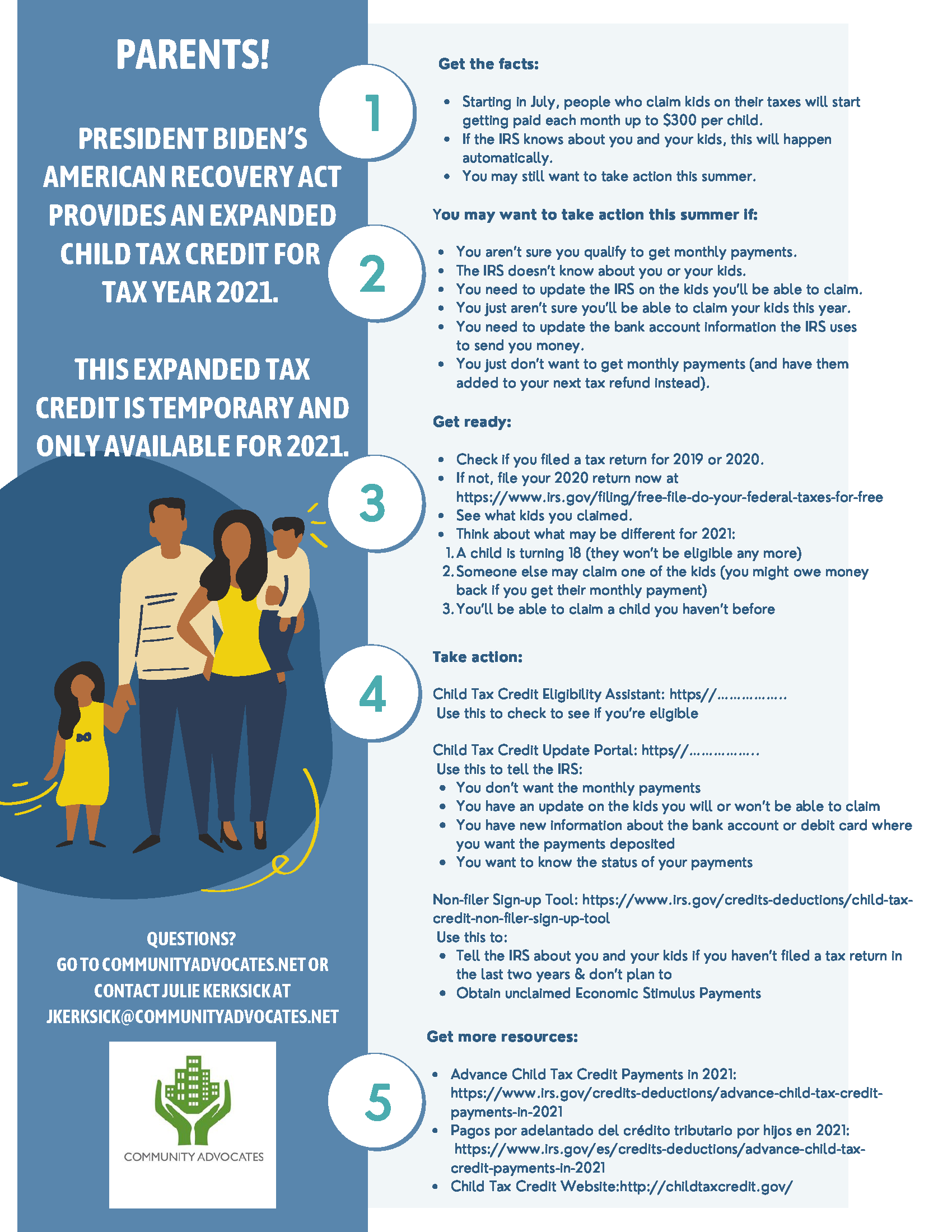

The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17. The American Rescue Plan Act expanded the 2021 Child Tax Credit CTC to almost 90 of children in the US including families with no earned income who dont usually file tax returns.

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

150000 if you are married and.

. Families that did not receive monthly payments can still claim the full amount of the Child Tax Credit they are eligible for when they file taxes. The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever. More Information 3000 per child 6-17 years old.

June 28 2021. Our analysis ofthe Child Tax Credit. The Child Tax Credit.

The maximum amount of the child tax credit per qualifying child that can be refunded even if. The IRS used the information from your 2019 or 2020 tax return to estimate your eligibility for monthly Child Tax Credit payments in 2021 and send payments equal to half of the amount of. The number to try is 1-800-829-1040.

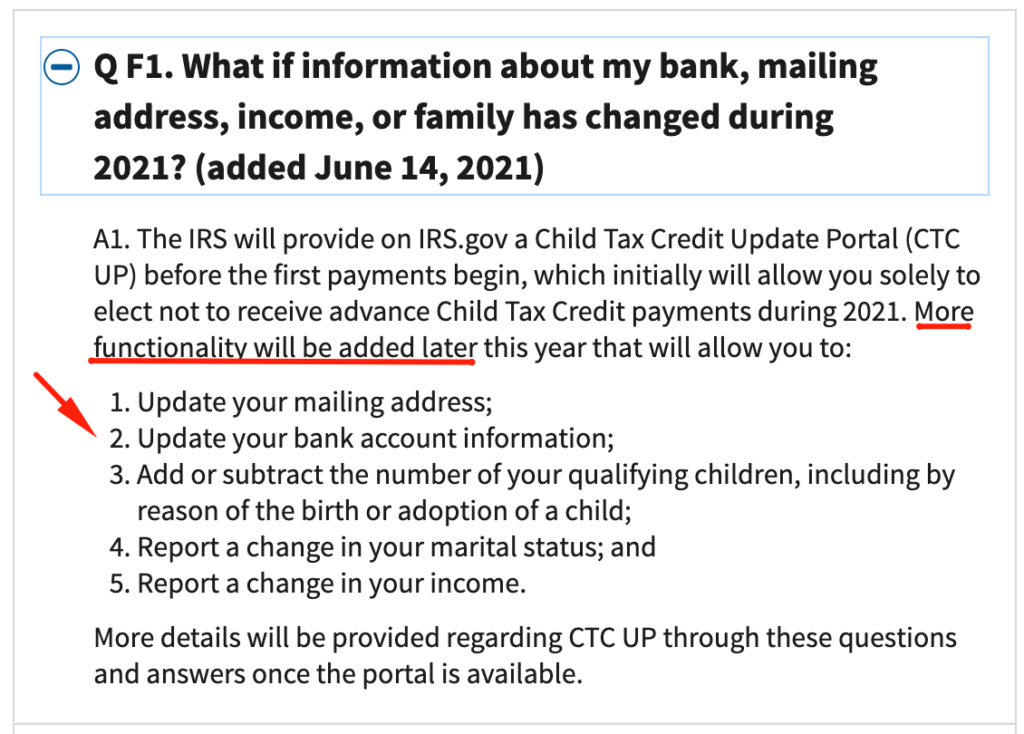

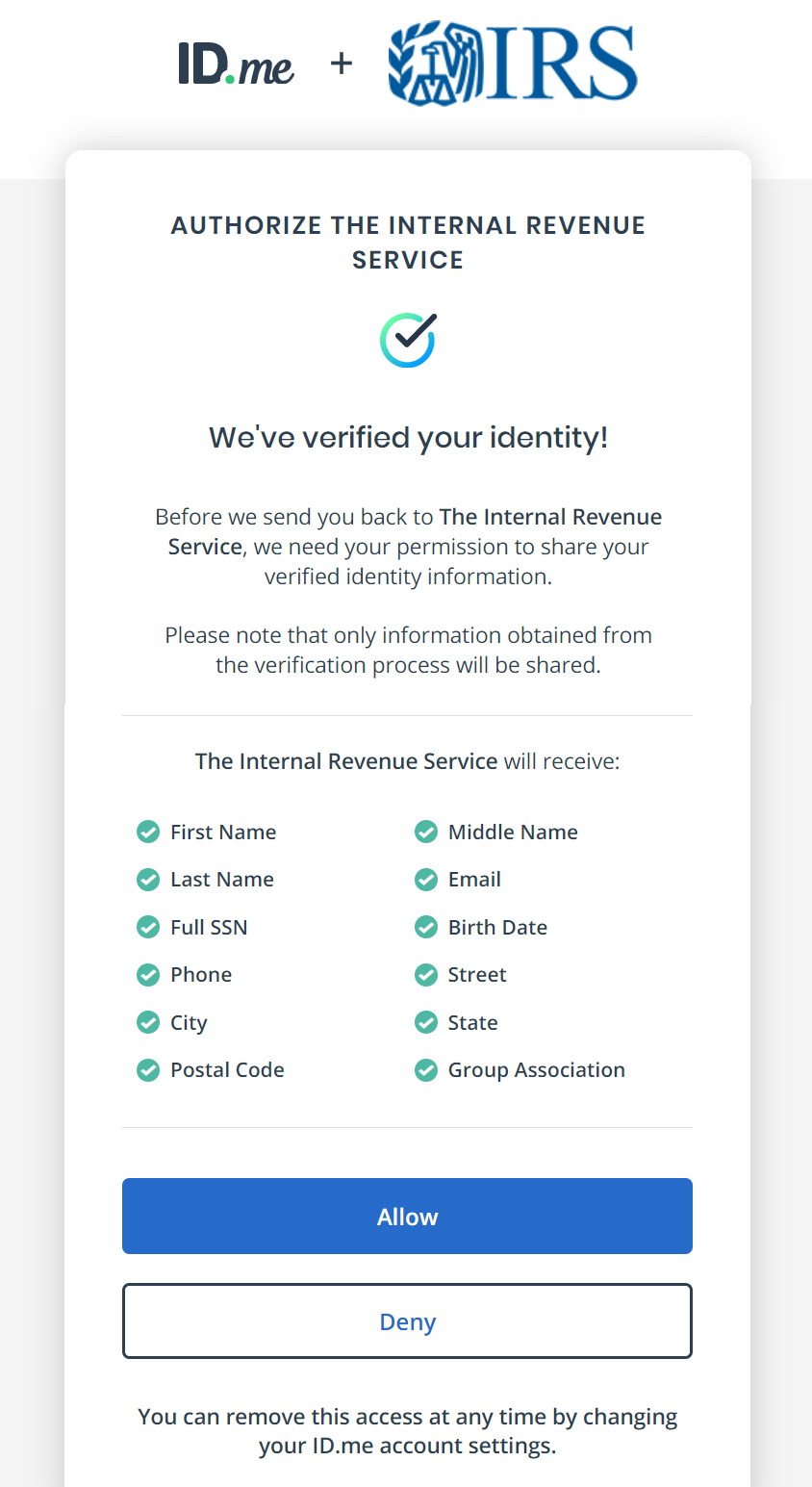

The Child Tax Credit Update Portal can be used by families to update the information the IRS has for them that may make them eligible for the credit. IMPORTANT INFORMATION - the following tax types are now available in myconneCT. 932 ET Jul 6 2021.

The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit. Connecticut State Department of Revenue Services. You can also use the tool to unenroll from receiving the monthly.

Making a new claim for Child Tax Credit. If you received any monthly Advance Child Tax Credit payments in 2021 you need to file. Department of Revenue Services.

The first advance payments of the bulked-up child tax credit are poised to go out to millions of American families in just over two weeks on July 15 - a key part of President Joe. Child Tax Credit Portal Use this tool to. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

Provide or update your bank account information for monthly. Visit ChildTaxCreditgov for details. By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes.

THE IRS has launched child tax credit online portals that will help parents to get the extra stimulus money when the monthly 300 payments begin. The amount of credit you receive is based on your income and the. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

Half of the money. Under a new law signed by President Biden on March 11 2021 individuals and families with children can get up to 300 per month per child under age 6. The Child Tax Credit provides money to support American families.

The amount you can get depends on how many children youve got and whether youre. The maximum amount of the child tax credit per qualifying child. The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children.

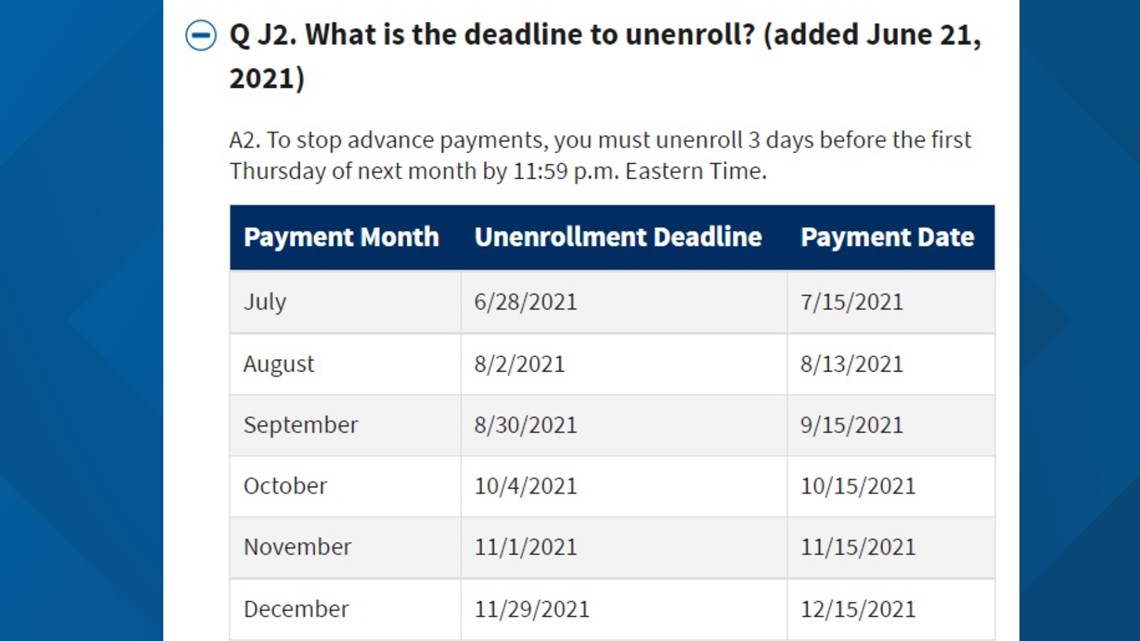

Child Tax Credit will not. Unenroll to stop getting advance payments. Why have monthly Child Tax Credit payments.

Already claiming Child Tax Credit. Check if youre enrolled to receive payments. For example if you call the IRS business phone number you wont get the answer youre looking for as the representatives at the end of.

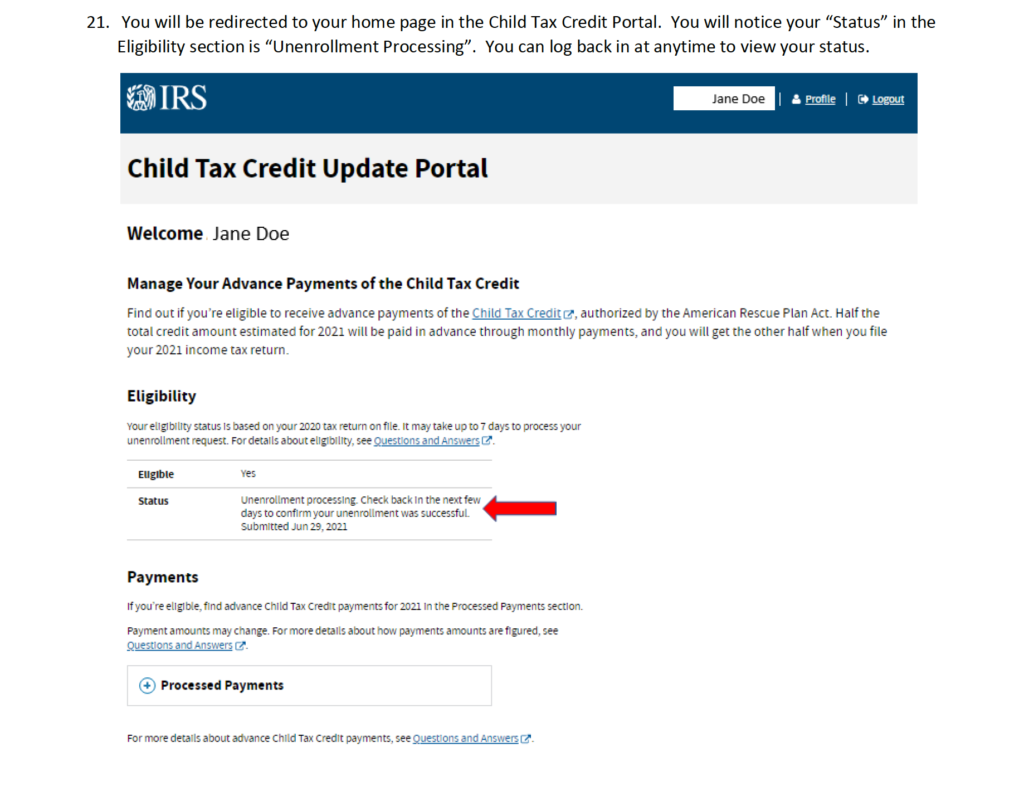

Here is some important information to understand about this years Child Tax Credit. The Child Tax Credit Update Portal allows you to verify your eligibility for the payments.

Irs Warns Child Tax Credit Portal May Have Wrong Amounts Accounting Today

November 15 2021 Deadline For Non Tax Filing Families To Use Child Tax Credit Portal Lone Star Legal Aid

Tools To Unenroll Add Children Check Eligibility Child Tax Credit

Child Tax Credit Irs To Open Portals On July 1 Checks Will Begin July 15 Where S My Refund Tax News Information

How To Opt Out Of The Advance Child Tax Credit Payments

New Child Tax Credit Portal For Qualifying Tax Payers

Child Tax Credit Portal How To Manage Monthly Payments And Opt Out The Us Sun

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Child Tax Credit Open To Unenroll And Check Eligibility

Child Tax Credit Portal Update New Non Filer Sign Up Tool 2021

Advance Payments And Child Tax Credit Update Portal

Child Tax Credit What We Do Community Advocates

Child Tax Credit How To Unenroll Accounting For Jewelers

Child Tax Credit Update Portal Internal Revenue Service

Child Tax Credit Portal Now Open For Non Filers How To Claim Up To 3 600 The Us Sun

I Got My Refund Https Www Irs Gov Newsroom Irs Updates 2021 Child Tax Credit And Advance Child Tax Credit Payments Frequently Asked Questions Facebook

Child Tax Credit Update Portal Internal Revenue Service

Child Tax Credit Resources Free Tax Services For Moms Let S Get Set

White House Unveils Updated Child Tax Credit Portal For Eligible Families